Global Textile Industry: An Overview

The global textile industry was estimated to be around USD 920 billion, and it is projected to witness a CAGR of approximately 4.4% during the forecast period to reach approximately USD 1,230 billion by 2024, according to a recent report.

The textile industry has evolved greatly since the invention of the cotton gin in the 18th century. This lesson outlines the most recent textile trends around the globe and explores the growth of the industry. Textiles are products made from fiber, filaments, yarn, or thread, and can be technical or conventional depending on their intended use. Technical textiles are manufactured for a specific function. Examples include an oil filter or a diaper. Conventional textiles are made for aesthetics first, but can also be useful. Examples include jackets and shoes.

The textile industry is an immense global market that affects every country in the world either directly or indirectly. For example, the people selling cotton increased prices in the late 2000s due to crop issues but then ran out of cotton as it was being sold so quickly. The price increase and the scarcity was reflected in the consumer prices of products that contained cotton, leading to lower sales. This is a prime example of how each player in the industry can affect others. Interestingly enough, trends and growth follow this rule as well.

From a global perspective, the textile industry is an ever-growing market, with key competitors being China, the European Union, the United States, and India.

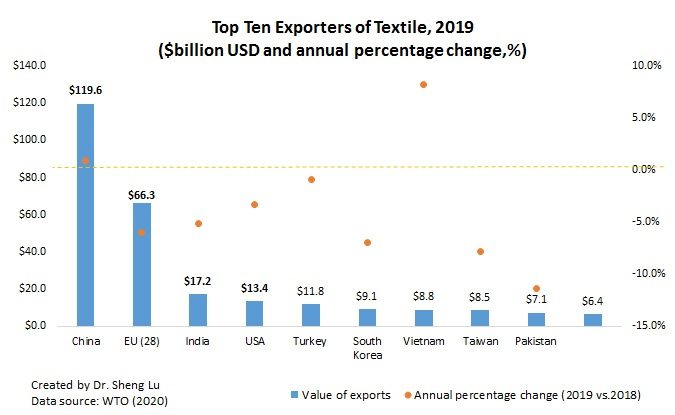

Top 10 exporters of textile, 2019. Source: Dr. Sheng Lu

China: World’s Leading Producer and Exporter

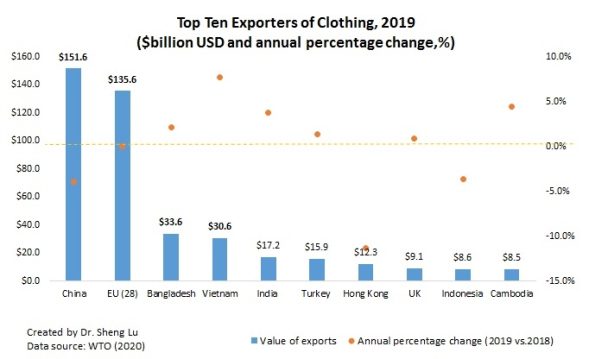

China is the world’s leading producer and exporter of both raw textiles and garments. And although China is exporting less apparel and more textiles to the world due to the coronavirus pandemic, the country keeps is position as the top producer and exporter. Notably, China’s market shares in world apparel exports fell from its peak of 38.8% in 2014 to a record low of 30.8% in 2019 (was 31.3% in 2018), according to the WTO. Meanwhile, China accounted for 39.2% of world textile exports in 2019, which was a new record high. It is important to recognize that China is playing an increasingly critical role as a textile supplier for many apparel-exporting countries in Asia.

The US: Leader Producer and Exporter of Raw Cotton And Top Importer of Raw Textiles

The United States is the leading producer and exporter of raw cotton, while also being the top importer of raw textiles and garments. The U.S. textile and apparel industry is a nearly $70 billion sector when measured by value of industry shipments. It remains one of the most significant sectors of the manufacturing industry and ranks among the top markets in the world by export value: $23 billion in 2018. At 341,300 jobs, the U.S. industry is a globally competitive manufacturer of textile raw materials, yarns, fabrics, apparel, home furnishings, and other textile finished products. Capital expenditures were $2 billion in 2017, the latest year for which data are available. In recent years, companies have focused on reorienting their businesses, finding more effective work processes, investing in niche products and markets, controlling costs through advanced technologies, and reshoring/nearshoring production.

Europe: A Leader In World Markets

The textile industry of the European Union comprises Germany, Spain, France, Italy, and Portugal at the forefront with a value of more than 1/5th of the global textile industry, and it is currently valued at more than USD 160 billion. Textiles and clothing is a diverse sector that plays an important role in the European manufacturing industry, employing 1.7 million people and generating a turnover of EUR 166 billion. The sector has undergone radical change recently to maintain its competitiveness with a move towards products with higher value added.

According to the European Commission, the EU textile and clothing industry is a leader in world markets. EU exports to the rest of the world represent more than 30% of the world market while the EU Single Market is also one of the most important in terms of size, quality and design. The Commission works to ensure a level-playing field in international trade. It does this at multilateral level through the application of World Trade Organization agreements, at bilateral level through negotiations on Free Trade Agreements, and via dialogues such the Euro-Mediterranean Dialogue on the textile and clothing industry, and bilateral dialogues with Colombia and China.

Top 10 exporters of clothing, 2019. Source: Dr. Sheng Lu

New Players: India, Vietnam and Bangladesh

According to the WTO, India is the third-largest textile manufacturing industry and holds an export value of more than USD 30 billion. India is responsible for more than 6% of the total textile production, globally, and it is valued at approximately USD 150 billion.

Vietnam exceeded Taiwan and ranked the world’s seventh-largest textile exporter in 2019 ($8.8bn of exports, up 8.3% from a year earlier), the first time in history. The change also reflects Vietnam’s efforts to continuously upgrade its textile and apparel industry and strengthen the local textile production capacity are paying off.

On the other hand, even though apparel exports from Vietnam (up 7.7%) and Bangladesh (up 2.1%) enjoyed fast growth in absolute terms in 2019, their gains in market shares were quite limited (i.e., no change for Vietnam and marginally up 0.3 percentage point from 6.8% to 6.5% for Bangladesh). This result indicates that due to capacity limits, no single country has yet emerged to become the “Next China.” Instead, China’s lost market shares in apparel exports were fulfilled by a group of Asian countries altogether.

The textile market has experienced a roller coaster ride over the last decade. Due to specific country recessions, crop damage, and lack of product, there has been a variety of issues that hinder the growth of the textile industry. The textile industry in the United States saw serious growth in the last half dozen years and has increased by 14% in that time. Although employment has not significantly grown, it has evened out, which is a large difference from the late 2000s when there were immense layoffs.

As of today, it is estimated anywhere between 20 million and 60 million people are employed in the textile industry worldwide. Employment in the garment industry is particularly important in developing economies such as India, Pakistan, and Vietnam. The industry accounts for approximately 2% of global Gross Domestic Product and accounts for an even greater portion of GDP for the world’s leading producers and exporters of textiles and garments.