Luxury Apparel Market: Industry Insights And Key Trends

The global luxury apparel market size was valued at USD 67.85 billion in 2018 expanding at a CAGR of 3.5% over the forecast period, according to the last report by Grand View Research.

Rising number of millionaires and brand loyalty among customers are anticipated to fuel the growth. Rising perception among consumers that luxury goods contribute to greater social acceptance, is driving the product demand. Increasing disposable income and consumer spending on luxury products are also prominent factors driving demand.

Many first time buyers of luxury apparels go for the products to experience high quality and to portray a certain image in the society. Most of the times, this converts into brand loyalty and as a result, they do not mind spending some extra amount for purchasing from their favorite brands. Recognized luxury brands have some consistency in the quality of the product and take extra care of consumer sentiments. This contributes to the evolution of brand name. Word-of-mouth conversation from public also plays a key role in promoting luxury clothing.

The higher price range and style quotient are some of the USPs of luxury apparels but the easy availability of duplicate products of top brands at cheaper prices is one of the major restraints for the luxury apparel market. Lack of awareness among consumers regarding the authenticity of these products leads them to purchase fake products, thereby affecting their brand loyalty. As per a study by Assocham, the fake luxury market in India is growing at a rate of 40% to 45% annually. This is one of the serious concerns for many manufacturers since it not only eats up their market share but also destroys the brand image with the low-quality products.

Luxury clothes are usually fashionable, trendy or high class, and expensive. Brands not only focus on providing the latest young looks but they also cater to the cultural trends and street culture to attract different consumers. For instance, Indian brand Raymond Group has introduced its new brand called Raymond Khadi to provide luxury khadi apparel. These kinds of innovations and developments are anticipated to continue attracting luxury customers and driving the market.

End-User Insights

By end-user, the market is divided into men and women. Men accounted for the largest market share of approximately 56.00% in 2018. Increasing sale of luxury workwear for men is propelling the segment growth. As per a survey, it was found that men spend more on luxury and are more likely to buy things for others than for themselves. Whereas it was also found that men and women shop for luxury items at around the same rate with the difference being in the spending on per item. The average pay for men and women across the world is also one of the prominent factors leading to men spending more on luxury apparels.

The market for women luxury apparel is anticipated to register a CAGR of 3.5% during the forecast period.

Distribution Channel Insights

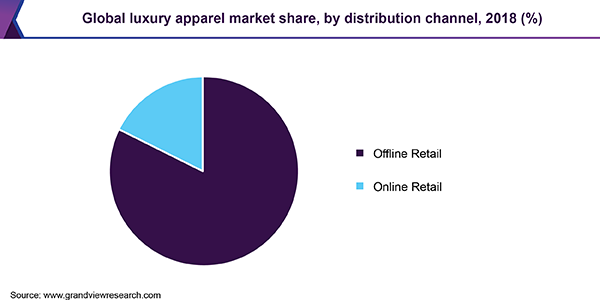

On the basis of distribution channel, the market has been divided into offline retail and online retail. Offline retail was the highest contributor to the market in 2018 owing to the high pricing and quality of luxury products. Consumers prefer to do physical checks in terms of material, fit, and other such factors before spending huge amount on luxury clothes. As a result, offline channel is anticipated to hold the largest market share. The multi-branded shops and specialist stores also provides a leverage of free alteration if it is required in certain clothes. The above factors drive the expansion of the offline distribution channels.

The online channel is expected to register the fastest CAGR over the forecast period. Both multi-brand e-retailers and own branded online stores interact with the consumers. The luxury dresses for all brands are not readily available at various shops and hence are accessible to limited consumers. People living in different countries can easily purchase such items through online channels. Also, the multi-brand online platform can reach out to time-pressed consumers who do not have much time to browse through different mono brand sites giving a wider opportunity for online retailing of luxury apparel.

Global luxury apparel market share. Source: Grand View Research

Regional Insights

Europe was the largest regional market for luxury apparel in 2018, with Europe, Germany, the U.K., and France being the prominent countries. Europe being one of the most attractive tourist destinations always attracts millions of travelers from across the world. Business tycoons to high-class women travelers buy expensive clothes while holidaying in Europe. The product sale is also on the rise, due to innovative retail concepts and business models in the region.

Asia Pacific has been witnessing strong growth over the past few years on account of increasing consumer awareness and brand consciousness among the regional consumers. China, Hong Kong, and India have the largest penetration rate for luxury clothing. A number of brands are exploring the untapped markets in the region and are establishing their stores owing to the rising demand. Some of the companies have also examined the potential in luxury children wear market and are trying to enter into such a market.

Luxury Apparel Market Share Insights

Some of the key market players are Georgia Armani, Burberry, Prada, and Dolce & Gabbana among others. The manufacturers are mainly concentrated in Europe and North America. High entry barriers, since most of the consumers are loyal to certain brands only, creates difficulty for small players to enter this market.

With a relatively concentrated competitive landscape, robust marketing campaigning is the key factor to retain the consumer interest. As a result, the key players are hiring various renowned celebrities for their marketing and promotional activities. For instance, Rihanna and luxury conglomerate LVMH launched a brand Fenty Maison in luxury products segment.