Textiles And Clothing Industries In The EU: An Ongoing Revolution

Textiles and clothing is a diverse sector that plays an important role in the European manufacturing industry, employing 1.7 million people and producing a turnover of €166 billion. The sector has undergone radical change recently to maintain its competitiveness by moving towards high value-added products and adapting to the challenges brought by the COVID-19 pandemic.

Characteristics of the industry

The textile and clothing industry covers a range of activities from the transformation of natural (cotton, flax, wool, etc.) or synthetic (polyester, polyamide, etc.) fibres into yarns and fabrics, to the production of a wide variety of products such as hi-tech synthetic yarns, bed-linens, industrial filters, and clothing.

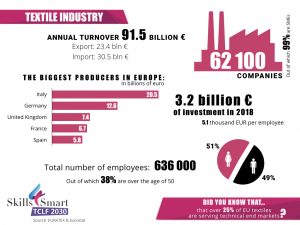

Textile Industry in the EU. Source: Skills Smart

The industry comprises

2 types of textile fibres

· ‘Natural’ fibres including cotton, wool, silk, flax, hemp, and jute;

· ‘Man-made’ fibres including those coming from the transformation of natural polymers (e.g. viscose, acetate, and modal), synthetic fibres (i.e. organic fibres based on petrochemicals such as polyester, nylon/polyamide, acrylic, and polypropylene), and fibres from inorganic materials (e.g. glass, metal, carbon, or ceramic).

The treatment of raw materials, i.e. the preparation or production of various textile fibres, and/or the manufacture of yarns (e.g. through spinning)

· the production of knitted and woven fabrics;

· finishing activities aimed at giving fabrics the visual, physical, and aesthetic properties that consumers demand. This includes bleaching, printing, dyeing, impregnating, coating, and plasticising;

· the transformation of those fabrics into products including

· clothes (knitted or woven)

· carpets and other textile floor coverings

· home textiles such as bed, table or kitchen linen, and curtains

· technical or industrial textiles

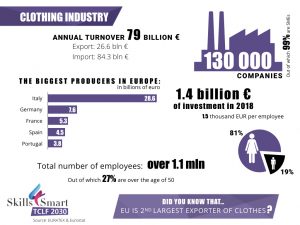

Clothing Industry in the EU. Source: Skills Smart

The retail sector is the last part of the textile and clothing value chain and is important for all textile and clothing products sold to the consumer. Although some textile and clothing companies have set up their own distribution networks as part of their vertical integration strategy, the manufacturing and distribution sectors remain very different in their characteristics. They should therefore be treated separately.

Economic importance of the industry

The textile and clothing sector is an important part of the European manufacturing industry, playing a crucial role in the economy and social well-being in many regions of Europe. According to data from 2013, there were 185,000 companies in the industry employing 1.7 million people and generating a turnover of €166 billion. The sector accounts for a 3% share of value added and a 6% share of employment in total manufacturing in Europe.

The sector in the EU is based around small businesses. Companies with less than 50 employees account for more than 90% of the workforce and produce almost 60% of the value added. The biggest producers in the industry are Italy, France, Germany, and Spain. Together, they account for about 3 quarters of EU production.

Southern countries such as Italy, Greece, and Portugal; some of the new EU countries such as Romania, Bulgaria, and Poland; and, to a lesser extent, Spain and France, contribute more to total clothing production. On the other hand, northern countries such as Germany, Belgium, the Netherlands, Austria, and Sweden contribute more to textile production, notably technical textiles.

With regards to external trade performance, about 20% of EU production is sold outside the EU despite limited access to many non-EU markets.

Competitiveness of the textile and clothing industry

The sector has been subject to a series of radical transformations over recent decades, due to a combination of technological changes, the evolution of production costs, the emergence of important international competitors, and the elimination of imports quotas after 2004.

Companies have improved their competitiveness by reducing or ceasing the mass production of simple products, and concentrating instead on a wider variety of products with higher value-added.

European producers are world leaders in markets for technical/industrial textiles and non-wovens (industrial filters, hygiene products, products for the automotive and medical sectors, etc.), as well as for high-quality garments with a high design content.

The trend towards higher value-added products needs to be continued in order to strengthen the competitiveness of the textile and clothing sector.

Competitiveness has also been retained by sub-contracting or relocating production facilities for labour-intensive activities, such as garment make-up, to companies in countries with lower labour costs, notably in the Euro-Mediterranean area.

Globalisation and technological progress has also led to a rethink in the textiles and clothing industry’s clustering strategy. While playing an important role for some activities, cooperation at local, district, or regional level has increasingly proved inadequate to ensure that the chain of production remains at close geographical proximity to the European market. Therefore, clustering of diversified activities is now also based on a wider geographical area, i.e. the Pan Euro-Mediterranean area. As a consequence, world leaders are EU brands. This is also true for high-end brands.